Gold Surges Past $2,500 in 2025: What’s Next for Traders

Gold has captured global attention with its remarkable performance in 2025, setting 37 consecutive all-time high records and reaching an astonishing $3,788.33 per ounce on September 23. Once again, gold’s reputation as a safe-haven asset has been proven right. Along the way, it has sparked intense debate among investors. For UAE traders, this milestone isn’t just a headline; it’s a signal. Understanding what comes next could determine whether you capture new profit opportunities or miss the next major move.

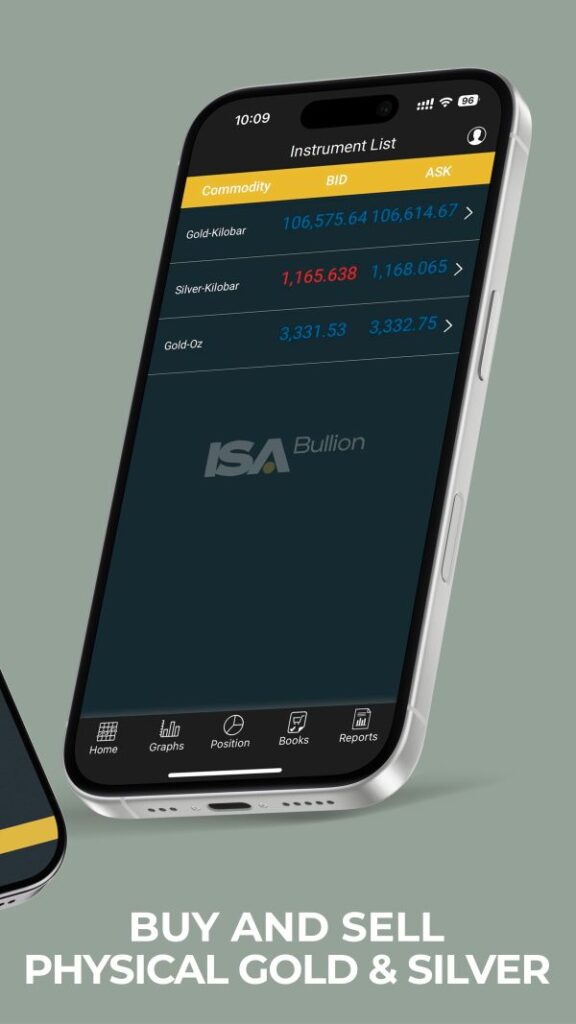

At ISA Bullion, we help UAE-based traders navigate precisely these market shifts, combining live global pricing, physical bullion ownership, and secure vaulting with real-time execution. Here’s what this price breakthrough means for gold’s future and how you can act on it with confidence.

Why Gold Has Surged Past $2,500

The rally above $2,500 didn’t happen in isolation. It’s the result of converging macro-economic and geopolitical pressures that continue to push investors toward hard assets.

· Global inflation persists – Even as some regions tighten policy, supply shocks and high commodity prices keep inflation sticky.

· Central bank buying remains strong – The World Gold Council reports record-high bullion reserves among emerging markets.

· Dollar weakness – As investors diversify away from USD-denominated assets, gold benefits directly.

· Geopolitical risk – From trade disputes to conflict zones, uncertainty drives safe-haven demand.

The result? Gold’s breakout is less of a bubble and more of a recalibration, one that reflects its lasting value when currencies and markets waver.

Analysts’ Updated 2025 Gold Price Forecasts

Now that gold has crossed the symbolic $2,500 line, the conversation has shifted from if to how far.

Forecasts from the London Bullion Market Association (LBMA) and other respected analysts project that sustained inflation and central-bank demand could keep prices elevated.

However, traders should temper optimism with realism. A strong rebound in the US dollar, easing inflation, or a global economic soft landing could all cap upside momentum.

Smart traders track data weekly, interpret sentiment shifts, and execute accordingly.

How UAE Traders Can Leverage the Momentum

For UAE residents, gold’s rise offers both protection and profit potential. ISA Bullion’s platform allows traders to respond instantly to global price movements. And every trade is backed by secure, insured vaulting.

Here’s how to stay ahead with us:

1. Open your ISA Bullion trading account

Set up your account in minutes, verify your details, and start trading 24/5 with transparent, live global pricing.

2. Monitor the market in real time

Stay on top of weekly forecasts and market drivers, from central-bank purchases to interest-rate announcements.

3. Diversify into silver and other metals

Silver often amplifies gold’s movements, giving active traders more volatility to capitalise on.

Could Gold Go Even Higher?

Some analysts suggest that if inflation remains entrenched and geopolitical tensions escalate, gold could rise well beyond $5000 per ounce by 2026 or beyond.

Key factors that could fuel another rally:

· Renewed US dollar weakness.

· Continued central-bank accumulation.

· Declining global bond yields.

· Surging demand for physical bullion in the UAE and Asia.

But as always, traders should stay agile and flexible. Gold’s volatility means that opportunities and reversals can unfold quickly.

Risks to Watch

Even as the market remains bullish, consider these downside pressures:

· A stronger-than-expected dollar rebound.

· Falling energy prices are reducing inflation expectations.

· Major economies are avoiding recession, reducing safe-haven demand.

The key is balance: protect capital, secure profits, and always base trades on verified data and disciplined risk management.

FAQs: Gold Price Forecast 2025

Has gold really broken multiple records in 2025?

Yes. Gold broke successive price records this year, reaching record highs amid inflation and geopolitical uncertainty.

Will prices keep climbing?

Many analysts think so, but forecasts vary. Keep tracking expert updates and trade based on data, not emotion.

Can I trade physical gold safely online in the UAE?

Absolutely. ISA Bullion offers insured vaulting, two-way pricing, and UAE regulatory compliance.

How can I stay informed?

Bookmark the ISA Bullion price forecast page and track forecasts weekly for the latest market insights.

Final Thoughts

Gold’s surge past $2,500 was a milestone, but it’s also a message. In times of uncertainty, real assets rise. The traders who thrive in 2025 will be those who pair insight with execution, acting on live data through trusted platforms like ISA Bullion.