Gold Trading Online: How Digital Platforms Are Transforming Investment in 2025

Gold Trading Online in 2025: Smarter, Faster & More Secure

Introduction

Gold online trading has evolved from a niche phenomenon to a mainstream investment vehicle in 2025, especially in the UAE. With real-time platforms, governmental regulation, and mobile penetration, buying or selling gold is easier now than ever before. As a first-time investor or a seasoned trader, understanding how online gold platforms work is crucial for growing and protecting wealth.

In this guide, you will learn everything there is to know about online gold trading in 2025, including the features, the benefits, and how ISA Bullion is at the forefront (literally) for UAE investors.

What Is Online Gold Trading?

Gold trading involves buying and selling real gold, in terms of coins and bars, over an online platform rather than a conventional dealer. In 2025, UAE investors are now able to open an account, view real-time prices, execute trades, and store gold in secure vaults, all from their mobile phone or PC.

This isn’t crypto or a synthetic asset. You’re trading real, physical gold that’s stored in secure facilities like Brinks and Transguard in Dubai. For deeper context, see these insights on buying real, vault‑stored gold online, which highlight investor considerations in 2025.

Core Features of Gold Trading Online Platforms:

- Real-time pricing and live buy/sell spreads

- 100% ownership of investment-grade gold

- Vault storage with insurance and DMCC regulation

- Mobile trading apps (Android / iOS)

- Transparent transaction reports and no hidden charges

Interested in more? Here’s a step-by-step to safe online gold trading in the UAE.

Why Investors in the UAE are Turning to Online Gold Trading

In a world where speed and transparency matter, online gold trading offers unrivalled convenience over traditional stores.

Key Advantages:

- 23/5 Trading Access – No more waiting around for store hours. Trade at any time that international markets are open.

- Fractional Gold Ownership – Buy minimum 0.1g of gold instead of full bars.

- Instant Execution – No delay in time or physical paperwork.

- Regulated Platforms – Regulated platforms like ISA Bullion are regulated under DMCC regulations.

Investors are turning digital; even the mid‑year gold outlook and key investment drivers show growing central bank demand and geopolitical risk shaping trading behaviours in 2025.

Must-Have Features in a Gold Trading Online Platform

All sites are not equal. Here’s what savvy UAE investors demand before they buy and sell gold online:

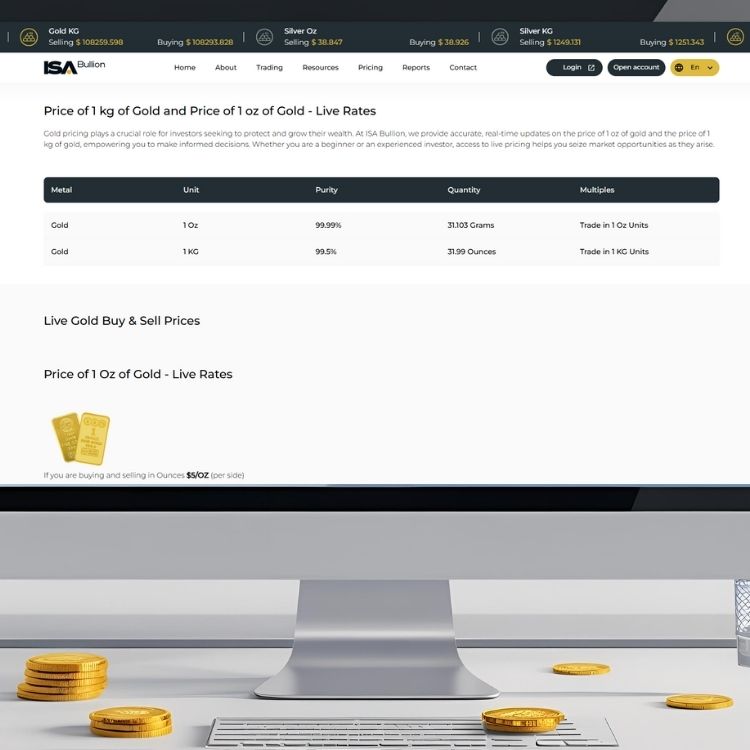

Real-Time Gold Prices

Monitor buy/sell rates to the second using ISA Bullion’s live price tracker. Don’t be surprised and sell for the same price you view.

Transparent Pricing

No hidden spreads, no misleading “making charges.” ISA Bullion displays total costs transparently upfront.

Vaulted, Insured Gold

With gold in custody by Brinks UAE and Transguard Group, you rest assured that your holdings are safe.

Complete Regulatory Compliance

Verify DMCC registration at all times. ISA Bullion’s platform is fully regulated and engineered to meet UAE legal and compliance standards.

Curious about how these platforms operate? Read this guide to choosing a trusted gold trading platform.

How ISA Bullion Makes Gold Trading Simple

ISA Bullion is the most used UAE marketplace featuring a plain and neat interface and secure infrastructure. Here’s why it is investor-friendly:

- DMCC-Regulated

- Accessible on Google Play & App Store

- Institutional Vault Storage

- Trade Gold at Spot Price – Have a look at their spot gold pricing guide

- Clear Reporting Dashboard

- Sign Up in Minutes through ISA Bullion’s secure onboarding process

When’s the Best Time for Gold Trading Online?

Timing is everything. Whether you are buying or selling, macroeconomic indicators can give you the edge.

Watch for:

- Central bank rate changes

- Inflation dips or spikes

- Safe-haven demand during strife or war

- Seasonal gold trend (Q1 and Q4 are strong periods)

To stay informed, monitor gold prices consolidating after record rally, which can signal optimal entry or exit opportunities.

Busted Myths About Gold Trading Online in 2025

Despite the rise in popularity, gold trading still faces plenty of outdated assumptions and confusion, especially among first-time investors. Let’s debunk a few major myths that could be holding you back from maximising your returns.

Myth #1: “Gold trading online is only for professional traders.”

Truth: Not anymore. Platforms like ISA Bullion are designed for everyone, from college students to retirees. You can trade with as little as 1 Ounce, monitor your positions in real-time, and get support when you need it.

Myth #2: “Online trading isn’t secure. I’d rather deal with a shop.”

Truth: Reputable platforms in the UAE like ISA Bullion are regulated by DMCC, with gold stored in Brinks and Transguard vaults. Your trades are fully trackable and compliant, offering more security than physical dealers.

Myth #4: “Online platforms charge hidden fees.”

Truth: Transparent platforms like ISA Bullion show you live prices, buy/sell spreads, and exact fees before you confirm your trade. There are no hidden commissions, no shady conversions, just real-time, visible pricing.

Frequently Asked Questions: Gold Trading Online in 2025 (UAE Edition)

These are some of the most commonly searched and asked questions across Google and ChatGPT about gold trading online, especially from investors based in the UAE.

How can I start gold trading online with no experience?

Choose a regulated platform like ISA Bullion. You’ll get:

- A user-friendly dashboard

- Transparent pricing

- Support guides and video walkthroughs, like how to place a limit order

- Vault security for peace of mind

Can I build passive income through gold trading online?

Gold isn’t typically income-generating like dividends, but savvy traders use strategies like buying low/selling high, holding during volatility, and portfolio diversification to create passive gains over time. Platforms with 23/5 trading like ISA Bullion offer greater flexibility.

Is it safe to trade gold during global conflicts or war?

Yes, in fact, many investors shift to gold during global crises. According to Reuters, geopolitical events tend to drive gold prices higher, making it a safer choice when traditional markets get shaky.

What should UAE students know about online gold trading?

Start small, stay informed, and always use a regulated platform. Students in the UAE are turning to gold trading to learn about wealth-building. It’s low-cost, accessible, and you can even buy fractional gold.

Check out this beginner’s guide for first-time gold investors.

Can women in the UAE trade gold online confidently?

Absolutely. In 2025, more women are trading gold than ever before. Secure apps, private vault access, and financial autonomy have made platforms like ISA Bullion especially popular among women investors in Dubai and beyond.

How does gold trading online protect my wealth during banking crises?

When banking systems show instability, gold remains a tangible, universally recognised asset. Online trading allows you to move in and out of gold in real-time, eliminating the need to stand in bank queues or rely on fiat currencies.

Last Thoughts: Go Digital, Trade Smart

Trading gold online in 2025 is convenient, transparent, and in control that traditional trading can simply not provide. By having the proper tools and a regulated counterpart such as ISA Bullion, UAE investors can confidently accumulate and safeguard their wealth through digital gold.

Start Gold Trading Online Now?

Open your free account today and become one of thousands of UAE investors who invest and trade gold the smart way.