How to Trade Gold Online: A Beginner’s Guide to Smart Gold Trading

Introduction: The Rise of Smart Gold Trading

In times of financial instability and techno-turbulence, gold still remains an asset class to which wealth seeks shelter. Over the past decade, the precious metals markets have shown remarkable resilience and evolution, making gold trading an increasingly attractive option for investors. With trading websites available over the internet, gold markets today are accessible to all, and investors can pursue Smart Gold Trading from the comforts of their home. This article is aimed at offering novices the information and resources necessary to play around on the website of gold trading online seamlessly.

Learning About Gold Trading: The Essentials

Smart Gold trading involves buying and selling gold to capitalise on market price movements. Unlike traditional asset classes, Smart Gold Trading offers multiple avenues for investors, each catering to different goals and risk appetites.

- Physical Gold:

Coins and bars are appropriate for those investors interested in physical ownership.

- Gold ETFS:

Investment funds that replicate the gold price movement are ideal for those who prefer paper gold exposure.

- Gold Futures:

Gold futures contracts allow speculators to wager on future gold prices.

- Gold Mining Stocks:

Stocks of gold mining and producing firms.

While both these systems have some particular advantages, new investors benefit the most with the purchase of physical gold with ownership, purity, and minimum risk involved. With a reputable, regulated website such as ISA Bullion, new investors have an easy way to buy and protect physical gold for live market rates coverage, insured vaulting, and transparent online trading.

ISA Bullion simplifies usage for members using complete control, live prices, and a guarantee, making it an ideal option for anyone new to the Smart Gold Trading experience.

Step-by-Step Guide to Gold Trading Online with ISA Bullion

The journey to smart gold trading is as easy as a seamless onboarding experience. This is how you can begin smart gold trading online with ISA Bullion:

- Create an Account:

Sign up on the ISA Bullion website. The website has been optimised for Smart Gold Trading right from the inception.

- Verify Your Identity:

Finish by submitting the documents requested, including a passport (and Emirates ID for UAE residents). This ensures regulatory compliance and secures your gold trades.

- Fund Your Account:

Deposit funds through secure payment methods, via bank transfers. Funding your account is the first step.

- Start Trading:

Utilise the platform to buy or sell gold at current market prices. Real-time pricing and responsive design on ISA Bullion make it ideally placed to carry out precise trades.

- Track Your Portfolio:

Track your trades, performance, and gold market movements with the built-in analytics and charting features of ISA Bullion.

- Daily Reports

ISA Bullion gives you daily market reports to update you on price action and news in the gold market. You require this update to be well ahead in Gold Trading and make smart choices.

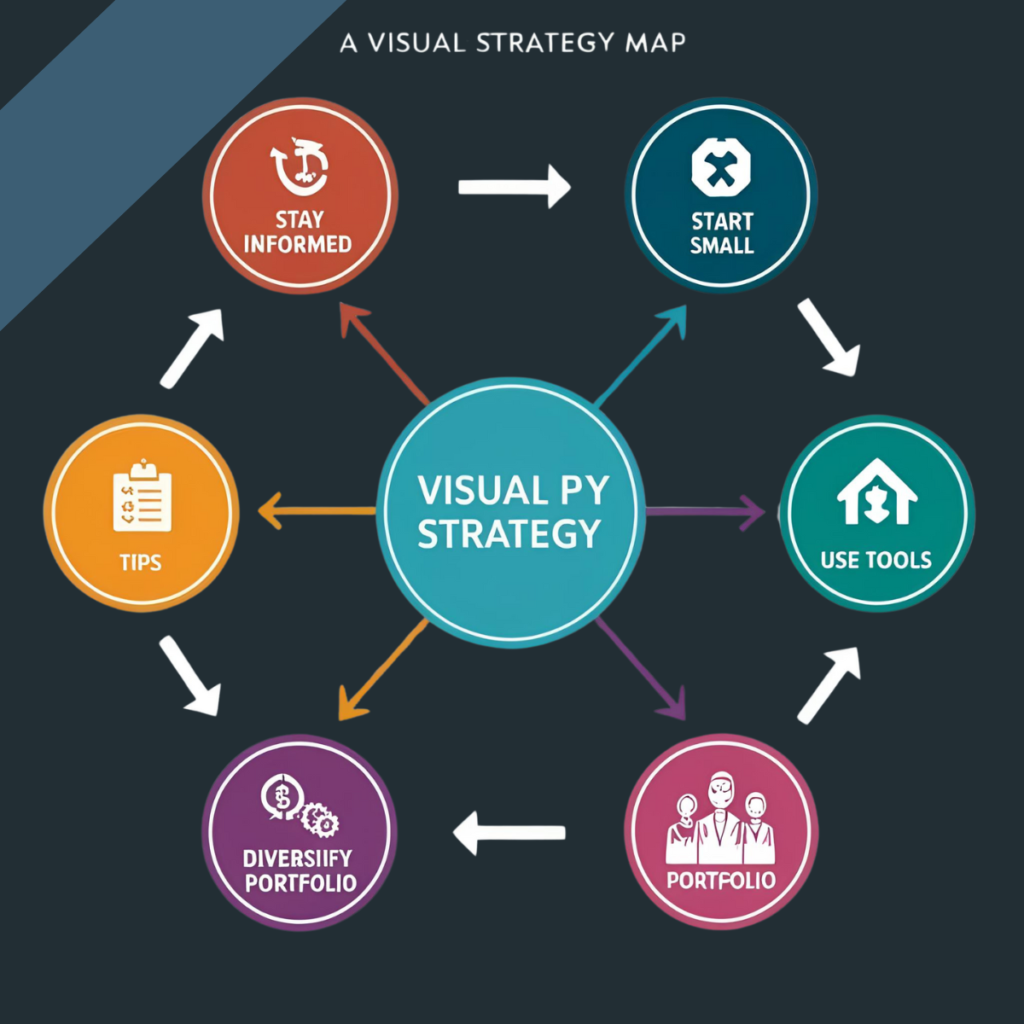

Smart Gold Trading Strategies

- Be Informed:

Make yourself up to date with worldwide economic indicators, geopolitical happenings, and market action influencing gold prices. Gold has historically proven to be a strategic asset across various market conditions, making it crucial for investors to stay informed.

- Choose your investment goal:

Whether it is wealth protection, diversification, or speculation return.

- Start Small:

Test Market Forces with Small Initial Investment Before Going Big-Scale.

- Use Advanced Tools:

Make use of ISA Bullion tools such as market orders, limit orders, and stop-loss facilities to trade at minimal risk.

- Diversify Your Portfolio:

Include gold in a diversified overall investment strategy to neutralise the risks of other asset classes.

Why ISA Bullion Is the Ideal Option for Gold Trading

ISA Bullion is among the most well-reviewed websites for Gold Trading, especially for beginners. Below are the reasons why:

- User-Friendly Interface:

Simple to use, with navigation made available to even novices. Learn more about getting started in our Secure Online Gold Trading.

- Real-Time Pricing:

Live gold prices ensure well-informed decisions and timely execution of trades.

- Secure Transactions:

Best-in-class encryption and compliance with rigorous DMCC regulations guarantee an extremely secure trading experience.

- Physical Gold Ownership:

Purchase gold outright at spot prices with complete ownership, securely stored in insured vaults, giving you peace of mind and asset protection.

- 24/5 Trading:

The ISA Bullion mobile app and web trader are available for Android and ios users.

The Benefits of Online Trading of Physical Gold

Online purchasing and selling of physical gold introduces the physical ownership of gold with the ease of online. Gold has historically maintained its value over the long term, making it an attractive asset for investors seeking security.

Transparency:

Open pricing with no hidden charges.

Security:

Stored in insured vaults.

Liquidity:

Easy selling and buying at market prices.

Ownership:

Physical gold, not promises on paper.

ISA Bullion provides that every transaction is supported by physical gold, and this helps investors feel secure.

Don’t Make These Common Mistakes

Trading gold can be very lucrative, but care must be exercised when trading it. Some of the common mistakes to avoid when trading gold with ISA Bullion include:

- Grossing up Research:

Lack of knowledge about market trends and indicators can lead to the worst investment decisions. It is essential to remain informed about the gold market, and ISA Bullion enables this through its live market data and daily updates. With this information, you can make informed decisions and evade unnecessary risks in Smart Gold Trading.

- Overtrading:

Repeated purchase and selling of gold incurs additional charges, and hence, you can unnecessarily incur a loss. It is necessary to be prudent and trade accordingly. ISA Bullion provides live prices so that you can monitor and steer clear of overtrading. Learn more about trading gold online with ISA Bullion for a more strategic approach.

- Neglecting Charges:

Not having the full cost is sucking the profit out of you. Always factor in trading fees, storage fees, and any other surprise charges. ISA Bullion makes its costs transparent, and with competitive prices, you can be confident you’re getting the best without any nasty shocks.

- Lack of Diversification:

Relying solely on gold for investment can increase your risks. While gold is a solid investment, diversification is key to managing potential volatility. With ISA Bullion, you can easily diversify by trading multiple ounces or kilos of gold, helping you build a more balanced and secure investment portfolio.

Conclusion: Begin Your Smart Gold Trading Experience

It’s never been easier to buy and sell gold online. With platforms like ISA Bullion, newcomers can enter the gold market without hesitation, with tools and resources designed to achieve success. With an education, defining what you’re looking for, and taking advantage of the channels available at ISA Bullion, you can make Smart Gold Trading a valuable component of your investment strategy.

Get started today by visiting ISA Bullion’s Gold Trading Page.