Sell Gold in Dubai: How to Know the Best Time to Exit in 2025

Introduction:

Knowing when and how to sell gold in Dubai can make a major difference in your returns, especially in 2025, when global inflation, shifting interest rates, and currency moves are rewriting the rules of gold trading. Selling gold at the right time in Dubai can be tricky. This 2025 guide breaks down expert-backed strategies, tools, and market indicators to help UAE investors sell gold confidently and compliantly.

If you’re new to online platforms, this explainer on how digital gold trading works in the UAE will help you get up to speed before executing a sale.

Dubai’s Gold Market Is Changing. Are You Selling Smart?

In 2025, Dubai’s gold market will be more digital, tokenised, and real-time than ever before. Investors can sell gold in Dubai with just a few taps, but knowing when to sell is where the real value lies. Whether you’re trading tokenised gold, reallocating your portfolio, or funding a milestone, this guide will show you how to exit at the right moment.

We’ll explore:

- Key signals to time your sale

- Smart tools to sell with precision

- ISA Bullion’s advantages for UAE investors

- And the myths that stop people from selling smart

Let’s make sure your gold sale in 2025 is as profitable and protected as your initial investment. If you’re unsure who to sell to, explore this guide on trusted gold buyers offering competitive rates.

Why Timing Matters When You Sell Gold in Dubai

Gold is traditionally a long-term asset, but in a digital-first market, timing your sale is more tactical than ever.

Today’s tokenised and fractional models allow investors to sell partial holdings 23/5 using platforms like ISA Bullion. That means the old advice of “wait for a price spike” doesn’t always hold true anymore.

Here’s why today’s investors can sell smarter:

- Real-time price tracking on ISA Bullion’s live price page

- Mobile trading apps allow fast decisions during market swings

Download ISA Bullion on iOS or Google Play

Sell Gold in Dubai Based on Market Triggers

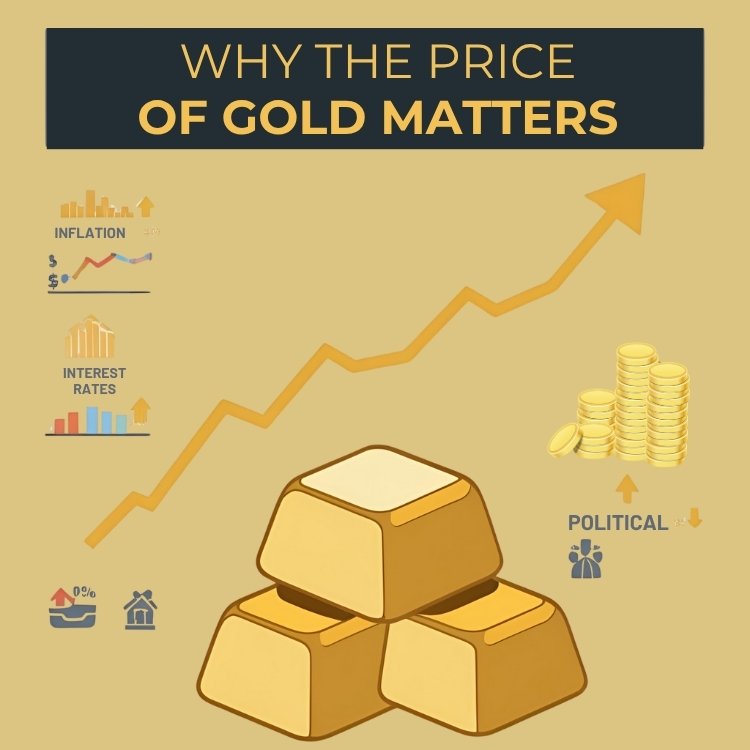

Even with powerful tools, macroeconomic signals still guide the best time to sell.

Real-World Signals to Watch:

Interest Rate Shifts

When central banks pause or cut rates, gold prices often peak due to lower opportunity costs. You can also review these expert tips for navigating price volatility when selling gold.

Inflation Cooling

A slowdown in inflation typically strengthens fiat currencies and reduces gold demand.

Geopolitical Calm

When global tension eases, safe-haven demand drops. This can be your cue to sell. You can also track the latest global gold price movements to see how external events like trade tensions affect timing.

Don’t forget to read ISA Bullion’s daily gold market reports for local insights before making a move.

Your Life Events Matter Too

Besides markets, personal goals drive when to sell gold in Dubai.

Consider selling gold if:

- You’ve hit a financial goal and want to lock profits

- You need cash for property, tuition, or reinvestment

- You prefer to rebalance your asset allocation

Using ISA Bullion’s dashboard, you can track price alerts and view real-time performance to help with timely exits.

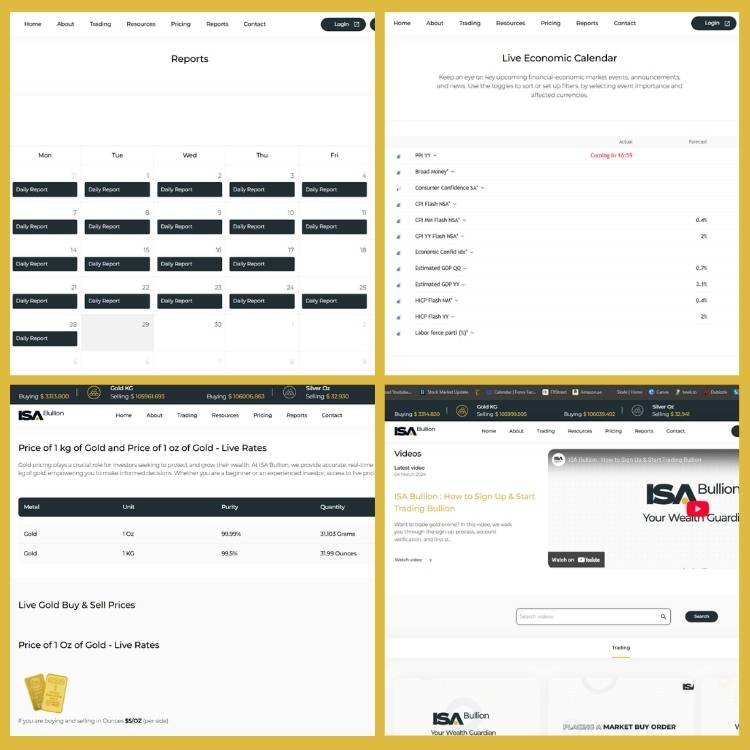

Tools That Help You Sell Gold in Dubai with Confidence

Timing is easier when your platform works with you, not against you.

ISA Bullion Offers:

- Real-time pricing with transparent spreads

- Limit and Market Order tools

Watch a quick limit order tutorial - Two-way pricing, know your buy/sell rates instantly

- Regulated by DMCC for 100% compliance

Learn how ISA Bullion’s secure and intuitive gold trading platform helps you sell gold in Dubai with ease, real-time pricing, and complete control.

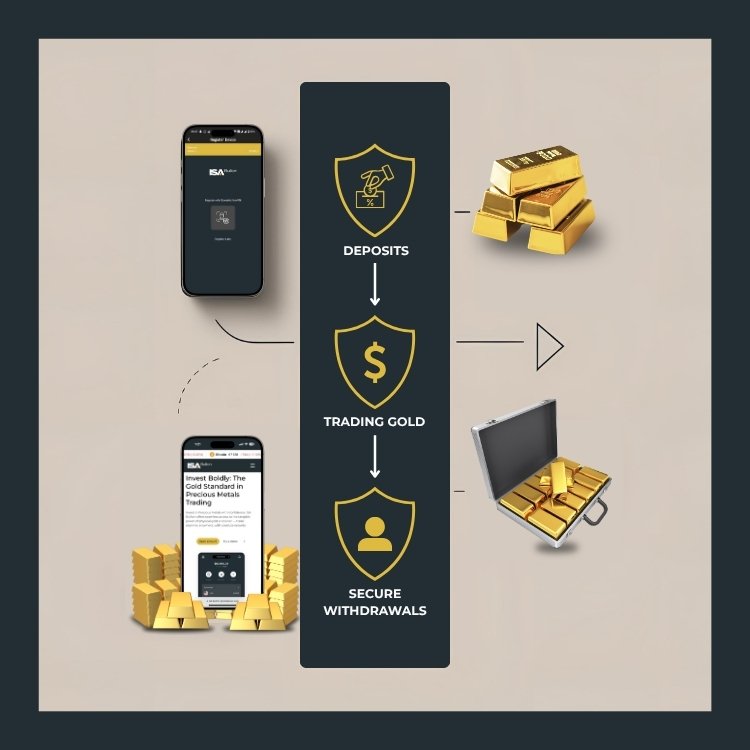

Logistics Matter When You Sell Gold in Dubai

Once you’ve decided to sell, the backend process should be airtight.

At ISA Bullion, you get:

- Vault storage by Brinks and Transguard UAE

- Full regulatory oversight by DMCC

- Insured withdrawal and delivery channels

These safeguards ensure that your gold sale is not only timely but safe, which is especially critical in today’s compliance-heavy ecosystem.

Don’t Miss the Seasonal Window

Historically, late Q1 and Q4 offer strong gold prices, especially around:

- Year-end portfolio balancing

- Festive demand spikes in the UAE and India

- Geopolitical year resets

Track seasonal movement with the ISA Bullion live gold price page, and align your sale with stronger market momentum.

Frequently Asked Questions: Sell Gold in Dubai (2025 Edition)

What’s the best way to sell gold online in the UAE?

The safest way is through a DMCC-regulated digital platform like ISA Bullion. It gives you access to real-time prices, instant trades, secure storage, and no hidden fees.

How can I avoid hidden charges when selling gold in Dubai?

Always check for:

- Transparent spreads (clearly shown before confirming your sale)

- No “making charges” or commission fees

- DMCC regulation

Platforms like ISA Bullion show exact fees upfront, so you never have to guess what you’re paying or receiving.

Is now a good time to sell gold in Dubai?

That depends on:

- Global signals (like inflation dips or interest rate cuts)

- Local spot price (check ISA Bullion’s live price chart)

- Your personal goals (liquidity, profit-taking, reinvestment)

You can also refer to a comprehensive guide to the fundamentals of gold investing and selling to align your exit strategy with macroeconomic trends.

Should I sell gold before a potential recession?

Many investors sell gold during pre-recession highs to lock in profits, while others hold for safety. If you believe gold has peaked due to safe-haven demand, it may be time to sell, but make that decision using live data and your long-term goals.

What’s the fastest way to sell gold for cash in Dubai?

The quickest route is to:

- Sell on ISA Bullion’s platform

- Withdraw cash securely to your linked bank account

- Avoid dealing with unregulated vendors or middlemen

This way, your transaction is legal, safe, and traceable.

Busted Popular Misconceptions About Selling Gold in 2025

Myth #1: “I’ll wait for gold to hit its all-time high before selling.”

Reality: Gold markets are quick, and it is nearly impossible to time the absolute peak. Rather, place limit orders on ISA Bullion to sell automatically at your desired price.

Myth #2: « Selling gold online in the UAE is risky. »

Reality: Not at all, if you’re trading on a regulated platform like ISA Bullion. Regulated by DMCC, secured by Brinks and Transguard, and completely compliant with UAE gold trading legislation.

Myth #3: « All gold selling platforms provide the same functionality. »

“Comparison of platforms showing why real-time pricing and transparent tools matter when you sell gold in Dubai”

Reality: Most platforms do not disclose fees or provide live price updates. ISA Bullion provides:

- Live price feeds

- Tight spreads

- Total trade execution control

So you always know exactly what you’re getting, no surprises.

Final Thoughts: Sell Smart, Sell Securely

In the tokenised gold era of Dubai, timing has never been more strategic to sell gold. With live pricing, regulation by DMCC, fractional trading, and safe custody, platforms like ISA Bullion enable you to sell gold in Dubai your way, with no guesswork.

Ready to Sell Gold in Dubai Like a Pro?

Create your ISA Bullion account now and start trading gold with real-time confidence, total transparency, and complete control.